We all make mistakes and encounter unexpected circumstances in our lives — A slip-up in your diet, falling off your daily workout routine, or miscalculating the funds in your account to name a few. Some situations in life can impact our finances negatively, causing you to take a hit on your credit score. But, there are things you can do to help you recover and build your financial health. Here are some tips to help get your credit score in tip-top shape.

1. Make payments on time.

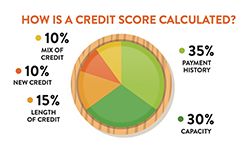

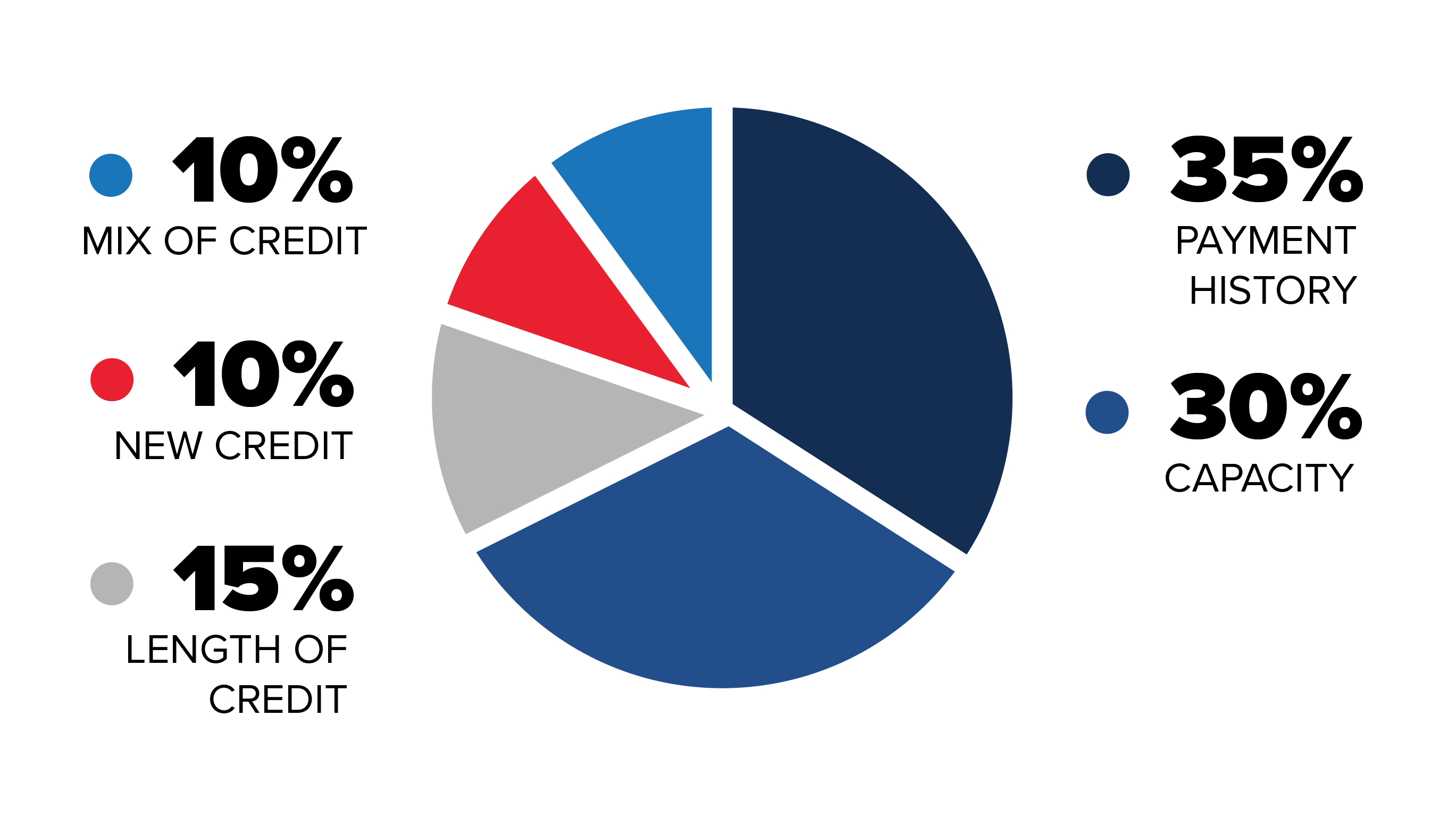

When it comes to how your credit score is calculated, payment history makes up the biggest part of your score. Your payment history shows how often you pay your bills on time and how often you make late payments or skip your payments. To improve your score, always pay your bills on time, even if you're just paying the required minimum balance. Enroll in automatic payments or set a calendar notification to remind you when bills are due.

2. Build your credit history.

Your credit history is an important component of your credit score. You can improve your credit history by building credit early and keeping your credit accounts open and active. But, this doesn't mean shop 'til you drop. You should never borrow more than you can comfortably afford to pay back. Opening a credit card and using it on occasion to keep it active will help build your credit history. If you're just starting off or need help rebuilding your credit, consider how a credit builder loan or secured credit card can help you get a fresh start.

3. Keep your balances low.

30% of your credit score is based on capacity. If you get close to maxing out all of your credit lines, it drops your score significantly, even if you're making your payments on time. You can improve your credit score by keeping your credit card balances low and paying down debt and past due accounts. If there are no penalties for doing so, consider making extra payments on your credit cards or loans each month.

4. Space out your credit applications.

Applying for new credit has a short-term negative effect on your credit score, so applying for a whole bunch at once may raise some red flags. Only apply for credit cards or loans when you need them.

5. Ask for help.

If you're struggling to make payments, you should speak with your lender. At Members First, your financial success is important to us. Speak with a Members First representative if you have any questions, need help formulating a successful debt repayment plan, or to see if you can negotiate a lower monthly payment or make other payment arrangements.

6. Maintain your credit health.

Whether you're working to build your credit or keep your credit score at its peak health, you should consistently keep tabs on your score. Review your credit report every few months to make sure the information on there is correct and dispute any errors you find. You are entitled to one free credit report every 12 months from each of the three major credit bureaus. You can request a copy at annualcreditreport.com. While you can request all three reports at one time, it's beneficial to request reports separately — so you can monitor the credit report more frequently throughout the year.

Do You Know Your Score?

Are you thinking about purchasing a new car, saving up for the down payment of your first home, or just looking for ways to improve your credit score? Members First is here to lend a helping hand by providing you the tools to help you make smart financial decisions. Plus, you can request to receive your credit score FREE and we'll share ways you can improve your score. Complete the following form and we'll contact you regarding your credit score and how to improve it.

RESOURCES

« Return to "Blog"