Graduation is an exciting time — you're closing an important chapter in your life and starting a new one that is full of possibilities. Along with that, however, comes new responsibilities and financial obligations. Making sure you have a strong financial foundation now will help you better meet your current and future financial needs. To help you navigate the transition to adulthood and financial independence, we're sharing some smart money-tips to consider.

Build a Budget That Works for You

After graduation, your living and working situations will likely change — impacting your budget. Take some time to determine your monthly income and expenses to build a budget that works for you. A good budgeting plan ensures that you're spending less than you earn, prepares you for life's curveballs, and funds your goals and dreams.

Build Credit

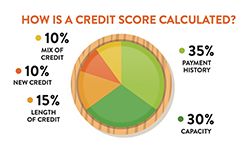

When the time comes to rent or buy a home, get a new car, qualify for a credit card, or fund a small business venture, having good credit history will help you get approved and snag the best rates and terms on the loan you need. Taking the time to familiarize yourself with how credit scores are calculated is the first step in getting a strong score and building good credit history. Other things to consider to help you create a positive credit history are:

- Set automatic payments and payment reminders using Bill Pay within Internet Banking to ensure you make payments on time.

- For a good credit score, keep your credit utilization below 50%. For a great credit score, keep your credit utilization below 30%.

- Avoid opening multiple credit accounts in a short period of time.

- Use your credit accounts on a regular basis and pay your bills on time.

Tip: Everyone's financial journey is unique. Depending on your personal financial goals and circumstances, a credit builder loan or secured credit card could set you on the right track to build or re-build your credit. Speak with a Members First Financial Service Representative to see if either of these options is right for you.

Pay Off Debt

Student loans, credit card bills, and auto loan payments are financial responsibilities for most college graduates. While it might feel overwhelming — don't ignore your debt. Make a plan to repay your debt before the amount becomes a financial burden:

- Make a list of all your debts — credit card, student loans, etc. Note the balance you owe, the interest rate, and the minimum payment for each debt.

- Total up your minimum payments and then define an additional amount you can put toward loan repayment.

- Choose a repayment strategy to help you organize and pay off your debt quickly.

- Snowball Method: Arrange and pay off your debts from lowest balance to highest balance.

- Avalanche Method: Sort and pay off your debts from highest interest rate to lowest interest rate.

- Consolidation: Take out a new loan to pay off your other debts, then make payments on your debt consolidation loan.

- Once you've chosen a repayment strategy that works best for you, create a prioritized list of your debts.

- Pay the minimum balance on all your loans each month with the exception of the one at the top of your list. For the debt at the top of your list, make the minimum payment plus the additional funds you determined in number 2.

Invest in Yourself

The first job you have after graduation is often a stepping stone on your career path. So, whether your goals are to land a better job or bigger paycheck, it's important to continually invest in yourself.

- Build professional relationships by networking with other professionals in your industry or field of interest.

- Attend training and development workshops and classes to help build your skill set, especially if they're free and come from a reputable source.

- Save for your dreams, goals, and for emergencies. Put some money into a savings account — even if it's just five, ten, or twenty dollars a week — and don't touch it. The earlier you start saving, the more your money will grow thanks to compound interest.

- Take advantage of employee benefits that may be available to you such as an employer match on your 401K or other retirement plan.

- Start an additional savings for your retirement like an Individual Retirement Account (IRA) and make regular contributions to further boost the funds available to you during retirement.

Protect Your Finances

With fraud on the rise, it's important to take steps to protect your information and finances. Here are a few best practices to follow:

- Never share your PIN, CVV code, Social Security Number (SSN), or login information with anyone.

- Use unique and secure login credentials for all your online accounts and never share your credentials with anyone. It's also important to regularly change your passwords for an added layer of security.

- Monitor your accounts regularly and keep your contact information current so that you can be alerted when unusual activity is suspected. Also, don't forget to monitor your credit report.

Did You Know? You are entitled to one free credit report a year from each of the three major credit bureaus — Equifax, Experian, and TransUnion. To request a free copy of your credit report go to annualcreditreport.com.

- Shred documents that contain personal or financial information.

- Be wary of unsolicited emails, calls, or messages. Don't click links or reply to messages. The best approach to deal with unsolicited emails or messages is to delete them or mark them as spam. You can also block unwanted numbers from contacting you on your phone.

- Be selective about what you share online because you could potentially be putting information out there that could be used by fraudsters to crack passwords, answer security questions, or pose as you.

RESOURCES

« Return to "Blog"