Reasons to Secure a Loan Before Visiting a Car Dealer

Thinking about getting a new car? A new car—and even a new-to-you car—is an exciting purchase! But before you dash off to the nearest dealership with your list of vehicle must-haves, learn how getting financing first is the smartest way to find your new ride.

Getting pre-approved first and apply at your local credit union before you start car shopping will help you to:

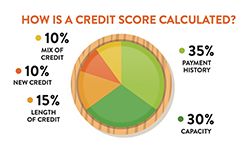

- Learn what size loan you qualify for and what interest rates and loan terms are available. Traditionally, credit unions are able to offer lower interest rates on car loans to their members than other lenders like banks or dealerships. Remember, the higher your credit score is the more likely you are to get a better rate. Consult with a financial representative at your credit union or order a free credit report (The FACT Act amendments of 2003 to the Fair Credit Reporting Act entitle you to a free copy of your credit report from each major credit reporting agency once (1) every twelve (12) months). If your score is not where you want it to be, it may be worth your while to put off your car purchase until you can improve your score. Consult with a financial representative at your credit union for ways to improve your score.

- Determine what size loan best fits your finances and budget to ensure you don’t over purchase. Want to crunch the numbers yourself? Check out our auto loan calculator.

- Shop where you want. If you get pre-approved first, you'll come with your own financing, giving you the freedom to choose a vehicle from any dealership.

- Protecting your investment with GAP (Guaranteed Asset Protection) is typically more affordable at your credit union. The cost of getting GAP through your credit union is generally half the cost of GAP from dealerships — potentially saving you hundreds up front.

- You may also get a bonus of free Auto Deductible Reimbursement (ADR) when you purchase GAP through your credit union. Most dealers do not offer ADR. At Members First Credit Union of Florida, your GAP purchase comes with the added bonus of free Auto Deductible Reimbursement.

- Purchasing MBP (Mechanical Breakdown Protection) at your credit union when you finance your car can also save you hundreds at the time of purchase. One of the benefits of getting MBP at Members First Credit Union of Florida is there is a $0 deductible on repairs.

- Negotiate. With a pre-approved loan amount, you'll be in a better position to negotiate the overall cost of the vehicle, instead of shopping to fit your monthly payment needs.

New vs. Used Cars

Do you know if a new or used car is the best fit for you? It's good to keep the following in mind when making your final decision:

![]()

New

![]() Usually comes with a brand-new warranty

Usually comes with a brand-new warranty

![]() Features the latest amenities

Features the latest amenities

![]() Has most recent safety features

Has most recent safety features

![]() Likely has highest potential MPG (Miles Per Gallon)

Likely has highest potential MPG (Miles Per Gallon)

![]()

Used

![]() Usually is considerably less expensive

Usually is considerably less expensive

![]() Can carry lower insurance costs

Can carry lower insurance costs

![]() Avoid the near-instant depreciation in value of a new car

Avoid the near-instant depreciation in value of a new car

WE'LL HELP YOU GET ON THE ROAD.

Members First Credit Union of Florida is here to lend a helping hand in putting you into the right vehicle to get wherever you're going. We offer auto loans with low, competitive rates and have a team of knowledgeable financial representatives to help you with any questions you may have along the way. Check out our auto loan resources below to help guide and get you in your new ride with ease.

Ready to Get Started?

We'll lend a helping hand with the application process or answer any questions you may have so you can get on the road quickly.

Speak With a Credit Union

Representative Today!

Call us at (850) 434-2211 and select option 2,

to speak with someone in our loan department,

or find a branch near you.

AUTO LOAN PROTECTION

Protect your loan with Extended Warranty, Guaranteed Asset Protection (GAP), and Insurance.

Avoid Costly Repairs

Drive with the peace of mind knowing that with Mechanical Breakdown Protection (MBP) you have protection against the increasingly high cost of repairs and associated labor costs for mechanical and electrical vehicle failures. In addition to repairing your vehicle, MBP provides services such as rental car allowance, tire protection, 24/7 roadside assistance, and towing. MBP is available for both new and used vehicles. This coverage will protect your vehicle after your warranty has expired. Ask us how you can drive with the proper protection against costly repairs!

Benefits of MBP

- $0 Deductible on Repairs

- Total Loss Refund

- 24/7 Roadside Assistance & Towing

- Rental Car Allowance

- Hybrid Battery Coverage

Need More Details?

For more details or to add this important protection product to your loan, call us at (850) 434-2211 or email us.

In most circumstances, your vehicle is worth a lot less the second you drive off the lot. Protect the investment made in your vehicle with GAP.

What is GAP?

Guaranteed Asset Protection, or GAP, is a voluntary, non-insurance program offered as protection on a new or used vehicle that is financed or leased. It is a supplemental benefit that enhances, rather than replaces, your standard comprehensive, collision, or liability coverage. GAP waives the difference between your primary insurance carrier's settlement and the payoff of your loan.1 In other words, it protects the "gap" between your vehicle's value and the amount you still owe in the case it is damaged beyond repair or stolen and never recovered.

How does GAP Work?

Depending on where you live, the established market value of your vehicle could be less than the actual balance you owe. In the event of a total loss or theft, GAP waives the difference between your primary insurance carrier insurance settlement and the payoff of your loan or lease, less delinquent payments, late charges, refundable service warranty contracts and other insurance related charges.2 Included in the deficiency balance is the deductible up to $1,000.

GAP Protection Benefits:

- Protection for the term of your loan up to 84 months

- Coverage for vehicles valued up to $100,000 at time of purchase

- Payment of benefits up to $50,000

- Coverage for auto insurance deductibles up to $1,000.00

- Benefits for new or used vehicles, including cars, light trucks, motorcycles, boats, RVs, and some other motorized vehicles

- Bonus: Free Auto Deductible (ADR)

ADR Protection Benefits (Included with our GAP Protection):

- Pays/Reimburses up to $500/per loss (unlimited losses per year) when a loss is filed and paid by the Auto Insurance Company for the Covered Auto.

Need More Details?

For more details or to add this important protection product to your loan, call us at (850) 434-2211 or email us.

1 Less delinquent payments, late charges, refundable service warranty contracts and other insurance related charges. 2 Subject to other applicable exclusions and limitations.

RESOURCES

We've got the tools you need to help you make the best decision for you, when purchasing your new/used car.

Rates, terms, and conditions are subject to change and may vary based on credit worthiness, qualifications, collateral age, and conditions. The APR will be disclosed prior to an advance being made on a loan.

* Interest will still accrue with the ‘No Payments for up to 90 Days’ offer. This is a limited time offer. Offer may be withdrawn or changed at any time without notice.

Go to main navigation