Thinking About Buying a Home? Here's What You Need to Know.

Are you thinking about buying your first home or upgrading to a larger house to accommodate a growing family? Members First is here to lend a helping hand with the home-buying process from advice to financing. Whether you’re in the initial states of the home-buying process (i.e. thinking about purchasing a house, but aren’t sure you’re ready yet) or are ready to begin shopping, here are a few questions to ask yourself to make sure you’re on the road to success to buy your new home.

Are your finances in order?

Buying a house is a big commitment and it may be the biggest financial decision you’ll ever make. Before you start falling in love with the condo downtown or the sweet house with the wraparound porch at the beach, you want to make sure you’re financially ready. Do you have other financial goals or commitments that may get in the way of buying your home? Using a budgeting calculator and mortgage repayment calculator can help you determine your budget and what home you can afford.

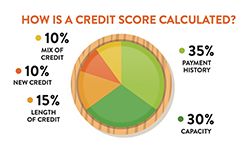

Once you’ve done that, check your credit score and start paying down debts. We've shared a few strategies for debt repayment here. A higher credit score and low debt to income ratio will help you qualify for a lower mortgage interest rate. Plus, knowing your score will help you determine if you should take the time to build-up your credit and hold-off on home ownership for a while.

If you have questions or concerns, make use of your credit union. Talk to a knowledgeable financial service representative.

Do you have a plan for the down payment?

Once you’ve determined what you can afford, you can start to figure out how much you want to save for a down payment. Although, 20% down payments are ideal, you can put down less. While a smaller down payment requires less money up-front, it means you’ll have to pay mortgage insurance. The type of home loan you use can impact the minimum down payment requirement.

Apart from your down payment, you’ll want to set aside money for closing costs. Closing costs generally run from 2% - 5% of the total cost of your loan. It is also a good idea to have an emergency fund in case your home needs unexpected repairs. When purchasing your home, you may be able to negotiate payment of closing costs and repairs with the seller, but since this is not guaranteed, it’s a good idea to have these funds set aside just in case.

What are your must haves in a home?

Create a wish list. Come up with a list of must-haves and nice-to-haves. Do you want a backyard? Do you want to be close to amenities like coffee shops, boutiques, or green spaces? If you have children or plan to have children, is there a particular school you want them to go to? Do you need a large kitchen for cooking or entertaining? Are you handy or is getting a move-in-ready home non-negotiable? All these things can impact the cost of your home and help you determine what you’re willing to compromise on during the home-buying process.

Ready to purchase your new home?

Learning about home loans will help you find the right mortgage for you. Learn the advantages and drawbacks of Conventional loans, FHA loans, VA loans, and more. Plus, choosing the right home loan can boost your chances of approval and save you money in the long run.

Once you’ve done your research and are ready to get pre-qualified or get a mortgage, start collecting paperwork you’ll need for your mortgage like:

- W-2 forms from the past two years (you may need more, if you’ve changed employers).

- Pay stubs from the past 30-60 days.

- Proof of other sources of income (including documentation of gift money).

- Federal income tax returns for the past two years.

- Recent bank statements.

- Details on long-term debts like auto or student loans.

- ID and Social Security Number.

We understand the process can be confusing or frustrating. That’s why we’re here to lend a helping hand with financial questions and concerns you may have. Give us a call at (850) 434-2211 or stop by a branch near you. If you’re ready, get pre-qualified today.

WE'LL HELP TO MAKE YOUR DREAM OF HOME OWNERSHIP A REALITY.

Choose a loan type below to learn more about it.

First Time Home Buyers Mortgage

Are you dreaming of buying your first home? Let Members First help your dream become a reality. You can rest easy knowing we have the right loan for you and that our mortgage loan officers have the knowledge and experience needed. So pack up, move, and leave the financing to us!

Members First offers the following terms for our First Time Home Buyers Mortgage:

- Lower Closing Costs

- No Points

- No Origination Fees (borrower pays only a $285.00 Document Preparation Fee)

- No Intangible Tax

- No Private Mortgage Insurance (PMI)

- No Prepayment Penalty

- Affordable Rate and Flexible Terms

- Down Payment as low as 3%

- Pre-Approvals

- Bi-weekly Mortgage Payments

Fixed Rate Conventional Mortgage Loan

A conventional mortgage is a home loan that isn't guaranteed or insured by the federal government and conforms to the loan limits set forth by Freddie Mac and Fannie Mae. You can get a conventional loan at a fixed or adjustable rate. Three other options – FHA, VA and USDA loans – are backed by the federal government.

Members First offers the following terms on our Fixed Rate Conventional Mortgage:

- Pre-Approvals

- Bi-weekly Mortgage Payments

- Competitive Rates and Terms

- Down Payment as low as 5%

- Pre-Approvals

- Bi-weekly Mortgage Payments

- Competitive Rates and Terms

Construction to Permanent Mortgage

Our Construction to Permanent Mortgage is a single close loan designed to avoid closing your loan a second time. Once construction is complete your loan will automatically convert to a permanent loan.

Members First offers the following terms on our Construction to Permanent Mortgage:

- One Time Closing

- No Points or Origination Fee (borrower pays only a $285.00 Document Preparation Fee)

- No Application Fees

- No Prepayment Penalty

- No Private Mortgage Insurance (PMI)

- No Intangible Tax

- No Escrow

- Fast In- House Processing, Underwriting, and Decisions

- Local Loan Servicing

Residential Lots/Land (Unimproved Property) Mortgage - Variable

Unimproved property is land without significant buildings, structures, or development. If you are considering purchasing land for a future home or maybe as an investment for later gain, look no further than our Residential Lots/Land (Unimproved Property) loan.

Members First offers the following terms on our Residential Lots/Land (Unimproved Property) Mortgage:

- 3 Year Adjustable Rate Mortgage (ARM)

- No Balloon Payment

- No Points or Origination Fees (borrower pays only a $285.00 Document Preparation Fee)

- No Intangible Tax

- No Escrow Required

- Competitive Rates and Terms

- Fast In-House Processing, Underwriting, and Decisions

- Local Loan Servicing

FHA Mortgages*

A FHA loan is a type of government-backed mortgage insured by the Federal Housing Administration (FHA). A key benefit to an FHA loan is a lower minimum down payment requirement (as low as 3.5%). Also, because FHA mortgages are government-backed, the loan program makes it easier to qualify for credit.

*For rates on FHA, VA, Investment Property, and Reverse Mortgage loan options, contact our Mortgage Group at 850-434-2211 Ext. 842.

VA Mortgages*

A Veterans Affairs (VA) Mortgage is government insured by the U.S. Department of Veterans Affairs, making it easier for qualified active duty service members and veterans to get financing to buy a home. For more information on VA loans, visit benefits.va.gov/homeloans.

*For rates on FHA, VA, Investment Property, and Reverse Mortgage loan options, contact our Mortgage Group at 850-434-2211 Ext. 842.

Investment Property Loans*

Looking to buy a second home or investment property? Members First can assist. Contact our Mortgage Group at 850-434-2211 Ext. 842.

*For rates on FHA, VA, Investment Property, and Reverse Mortgage loan options, contact our Mortgage Group at 850-434-2211 Ext. 842.

Ready to Get Started?

We'll lend a helping hand with the application process or answer any questions you may have so you can turn the key and open the door to your new home.

Speak With a Credit Union

Representative Today!

Call us at (850) 434-2211 and select option 2,

to speak with someone in our loan

or mortgage department, or find

a branch near you.

RESOURCES

We're here to lend a helping hand so you can take control of your debt.

MEET OUR MORTGAGE TEAM.

Rhonda Nelson

Mortgage Loan Manager

NMLS# 1119389

(850) 434-2211 Ext. 171

Email Rhonda

Mary Wade

Mortgage Loan Officer

NMLS# 490544

(850) 434-2211 Ext. 185

Email Mary

Amy Garrett

Mortgage Loan Processor

NMLS# 1470666

(850) 434-2211 Ext. 215

Email Amy

Is one of our Mortgage Team members busy or out of office? Email the Mortgage Group or call us (850) 434-2211 Ext. 842 and our next available team member will be there to assist you.

* For rates on FHA, VA, Investment Property, and Reverse Mortgage loan options, contact our Mortgage Group at 850-434-2211 Ext. 842

APR = Annual Percentage Rate. All loans are subject to credit approval. Rates and terms are based on individual credit worthiness. Terms and conditions apply. NCUA Insured. Equal Housing Lender. NMLS# 405711.